Many homeowners are under the assumption trying to sell their homes during the winter is a bad idea. However, the numbers show otherwise. The housing market doesn’t dip in winter months as much as people think, and plenty of buyers are still out looking for the right deal. There’s no need for homeowners to wait until spring to put their houses up for sale or pull their properties from the market starting in November.

“There are plenty of people who need to buy a home in the winter, whether it’s because of a job relocation or major family change, like a new baby” said Redfin real estate agent Paul Stone. “These buyers want to get into a home quickly, and are sometimes willing to pay top dollar.”

Follow the numbers

According to data released by Redfin last December, homes put on the market during winter months between March 2011 and March 2013 were more likely to sell by 9 percentage points compared to homes listed during warm months. Not only were they more likely to sell overall, but the homes listed December through March sold faster and for more money compared to homes listed during other months. On average, 56 percent of homes entering the market during non​-winter months sold within six months, while 65 percent of homes listed during winter sold within six months.

Go against the grain

Homeowners willing to ignore the naysayers and follow the numbers should spruce up their homes for winter to draw in potential buyers.

It’s true the dark and cold could potentially put buyers off from house shopping, but the right amount of curb appeal will get them into their coats and to a seller’s door for a showing. Sellers can take advantage of the holiday cheer and winter aesthetics by adding outdoor lights and hanging wreaths on the front door – maybe even putting some flameless candles in the windows to make the inner warmth of the home seem enticing.

Not only is what buyers see important, but also what they smell when entering a home. Homeowners can use pine in wreaths to evoke pleasant winter memories or bake a few sugar cookies before a showing.

Additionally, sellers should make sure to always keep their walks clear of snow and ice so that buyers don’t see potential safety hazards before they get to the door.

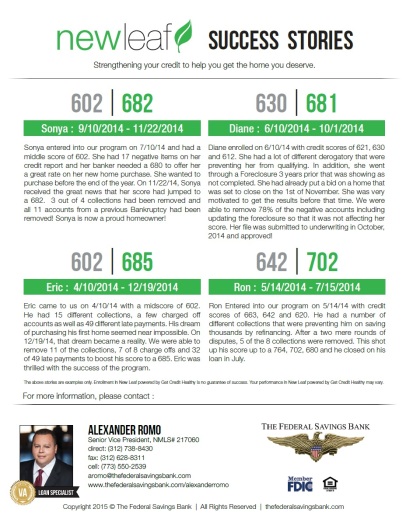

First-time home buyers shopping in winter should contact Alex Romo at the Federal Savings Bank, a veteran owned bank, to learn more about low rate mortgages and the pre-approval process.

Filed under: Housing Market, Uncategorized, Alex Romo, Alexander Romo, Home Buying, Home Loans, Home Ownership, Home Purchase, Home Sale, Housing Market, The Federal Savings Bank, The Romo Report

With the Holidays coming up, stores are rolling out the “savings” with “discounts” and “zero % credit cards”.

With the Holidays coming up, stores are rolling out the “savings” with “discounts” and “zero % credit cards”.